People who have been injured in a car accident do not usually understand the claims handling process and the complexities that go along with the injury claim. Insurance companies train their adjusters to handle claims in a manner that reduces or eliminates their need to pay the claim. Obviously, the less money and insurance company pays out in adverse claims the more profit for the company.

This is particularly true with claims against a third-party insurance company that ensures someone who ran into you as the insurance company owes you no duty and their claims handling practices are not scrutinized by the Texas insurance department.

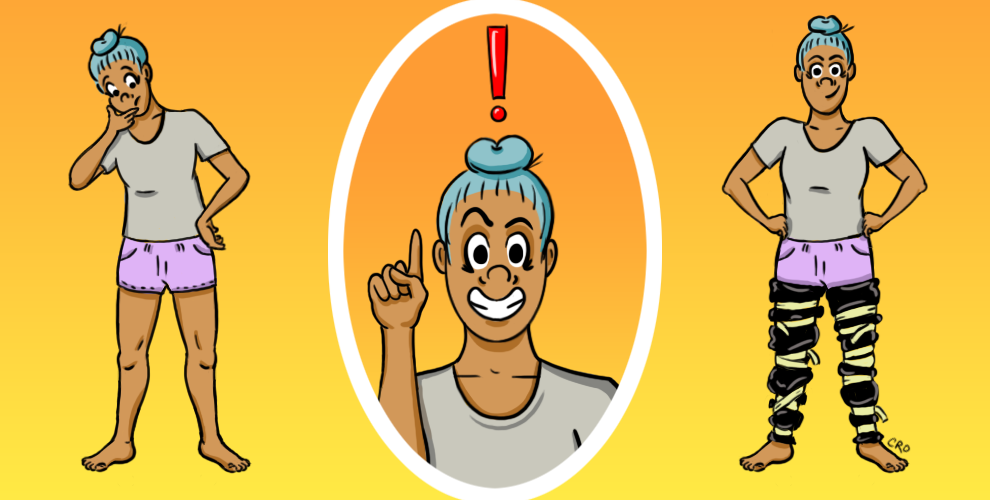

Here are the top 10 tricks that car accident victims find themselves learning the hard way when trying to handle a personal injury claim on their own.

- They do not respond.

People who are in a car accident and expect the insurance adjuster to contact them are often surprised when they do not receive a phone call. Even after the first contact with the adjuster, they find no follow-up and their telephone calls were not returned. This is particularly frustrating to people who are handling their own injury claims because they do not expect an adjuster to avoid them. This is part of the design of having an adjuster handle hundreds of cases at a time in that it makes it very difficult if not impossible for reasonable service to occur.

- Delay.

As with failing to respond to your telephone calls and inquiries one common thread in tactics for handling car accident claims is the delay tactic. The longer the adjuster can drag out the claim, the longer they keep their money earning interest and the better chance they have of settling the case down the road for peanuts. The general statute of limitations in Texas is two years from the date of the accident. The closer that the adjuster can get the claim to the statute of limitations the better for the insurance company. Most of the better personal injury attorneys in the Houston area will not accept a case that is only days or weeks away from the statute of limitations. So never wait until the last minute to think about getting an accident lawyer. In some cases, the injured person fails to take appropriate action within the two-year limitation period and they have effectively waived their claims.

- More information.

One tactic that is part and parcel to the delay tactic above is due ever more request additional information. Usually this revolves around medical treatment and the adjuster will usually say they can not make a decision until they have the additional records. After those records are obtained, the adjuster will find another piece of information that they need in order to proceed and so on… This is part of the delay tactic above and a trick than many automobile accident victims experience.

- Statements.

Many adjusters tell the personal injury victim that they cannot proceed on the claim unless they have a statement. This usually is not the whole truth and many good attorneys refuse to provide statements from their clients particularly in clear liability matters. When the adjuster takes the statement from an unrepresented person, the intent is usually to find a way to defend the claim as opposed to simply obtaining information necessary to value a claim. Usually the adjuster tries to take a statement very early on in the process and often before the car accident victim has been fully diagnosed with their medical problems. Additionally, part of the statement also includes leading questions such as “when did you first see.”, “What did you do to avoid…” and the like. These are calculated to do nothing more than give the adjuster an excuse to discount the claim or to be used against you in court.

- Implying you don’t need an attorney.

Usually, the adjuster will say something like “we accept responsibility“, “our insured was at fault” and the car accident victim assumes that means that the adjuster will be fair and reasonable when talking about settlement. Nothing could be further from the truth. This is part of a designed program to pay out as little as possible on car accident claims. If the adjuster can script the relationship such that the car accident victims believes that they can handle the case on their own, without an attorney, the insurance company will surely pay less money ultimately on the case. In the meantime, the insurance company can get a statement from the car accident victim that can be used against them and obtain other information that will do nothing but hurt the case.

- Asking for a release of all your medical records

An insurance company adjusting a car wreck claim as a reasonable right to ask for relevant medical records that pertain to the injury sustained in the accident. However, in practice what the insurance company will do for those representing themselves is to ask for an unlimited release of medical records through an authorization for release of medical. The releases usually are not limited in time and usually do not include only those medical records related to the wreck, but rather all of your medical records to the date of your birth may be obtained by the insurance company. Surely, records more than 10 years prior to the accident are not relevant for anything.

- Dispute and discount medical expenses.

One trick that adjusters frequently use is to “disregard” or “disallow” some of your medical expenses incurred by following your doctor’s orders for injuries sustained in the accident. They use many different justifications from the amount was too much, to the treatment was disallowed. In every instance though you can be sure that the adjuster will find issues with your medical treatment. It may be that the treatment was “excessive” or maybe that there were “gaps” in treatment or the treatment was not warranted or unrelated to the injury caused by the accident (according to the insurance company). This is a common trick used both in settlement negotiations and for litigation defense.

- Settlement offers based upon copayments.

Car accident victims who do not understand the laws of the state of Texas often are made offers based upon the out-of-pocket expenses or co-pays that they paid to the medical providers. In other words, if your health insurance company paid $4500 and your out-of-pocket expenses were $500 the offer would be based upon your out-of-pocket $500 in expenses and not the whole medical bill that was paid. This leaves unsuspecting people in a trap when their health insurance company asks later for reimbursement of amounts collected from third parties after an accident. It is also contrary to the law in the state of Texas where car accident victims are entitled to collect the whole amounts “paid or incurred” for medical expenses related to the accident. Your medical claims are not limited to co-pays but also include amounts paid by your health insurance company or all related medical expenses outstanding and unpaid that are reasonably related to the injury sustained in an accident.

- Lowball offers.

Usually the time when the car accident victim first understands that they really need an attorney is when the subject of money comes up. Until then, they had been told that the insurance company was accepting responsibility for the accident and they mistakenly believe that that would lead to a reasonable offer. When insurance company says they “accept responsibility” that usually only implies you will receive an offer and has nothing to do with the fairness of the offer and as a rule, for those not represented by experienced counsel, the offer is almost universally a joke. One reason for this tactic is that up until the time the people understand they need a lawyer; the insurance company is driving the process. In the meantime, they have obtained all of your medical records, even those they would not otherwise obtain and have taken a statement that they can use against you in court. Further, the cases been substantially delayed and that has consequences as well.

- They spy on you.

In cases where there is substantial insurance coverage such as a commercial vehicle or a company vehicle, many companies hire “investigators” to monitor the accident victim and obtain video film of them after the accident. Typical cases would include investigators sitting in parked cars down the road from your home with the hope of filming you doing something physical like playing with your children, dumping the garbage or mowing your yard. It is very important that accident victims are forthcoming with the extent of their injuries and not exaggerate them. Usually the investigators are brought out when the company believes that the victim may be exaggerating.